Learn how to conveniently make online custom duty payments in India with this step-by-step guide. Discover the process to ensure smooth and hassle-free transactions for your imports. Read on to find out how you can pay customs duties online and streamline your import operations.

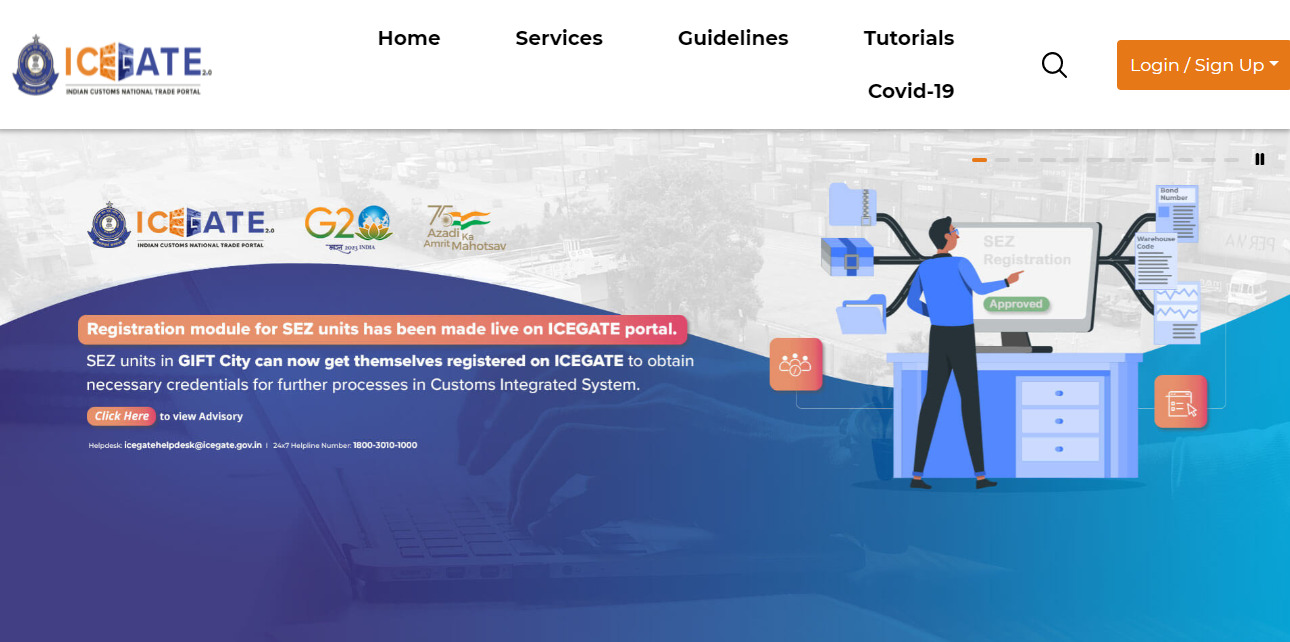

Use your unique credentials to log in to the ICEGATE portal securely.

Find and navigate to the “e-Payment” section on the ICEGATE portal.

Choose your preferred payment method from the available options, such as online banking, credit/debit card, or designated payment gateways.

Important Points Light Box

Update the Bill of Entry with the payment details, including receipt number and date.

Streamline your import operations and simplify the payment of custom duties with the convenience of online payment options in India. By following this step-by-step guide, you can efficiently make online custom duty payments through the ICEGATE portal. Embrace the benefits of digital transactions and ensure a smooth import process by leveraging the online custom duty payment facility provided by Indian customs authorities.

Let us know your feedback on this article “Guide to Online Custom Duty Payment in India” in the comments below 👇

Sunil Kumar Sah @DigitalSunilSah

Sunil is an E-commerce Seller, Blogger, YouTuber and Digital Marketer. He is a digital enthusiast and passionate about Online Selling. He loves sharing his knowledge and experiences on eCommerce in this blog and on his Hindi YouTube Channel “Ecommerce with Sunil” and the English Channel “Ecomsprint“

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |