Learn about the basics of a cheque and how to make a safe cheque payment in India. We will also discuss some check payment rules in India that everyone should know before writing their first cheque.

A cheque is a dated and signed document that instructs a bank to transfer a certain amount of money from a person’s account to the person named on the cheque. According to the Negotiable Instruments Act of 1881, a cheque is a sort of bill of exchange.

Cheque has been a commonly used payment instrument for a long time, and in India, individuals prefer to write checks rather than make online payments.

On a daily basis, businesspeople write a large number of checks to pay their vendors or customers.

People like cheque because they allow payees legal rights to obtain money back in case of defaults under the negotiable instrument act of 1881.

When writing checks, it appears to be a straightforward process, but there are numerous flaws that allow fraudsters to alter the check and steal your hard-earned money. Someone else could use your check if you are not careful when writing it.

The Reserve Bank of India (RBI) said in response to an RTI query filed by this PTI journalist in 2018-19 that 6,801 fraud incidents were reported by scheduled commercial banks and select financial firms in the previous fiscal, involving an amount of 71,542.93 crore (over 73 % rise in the fraud amount).

For further information, please refer to www.rbi.org.in

Many bank frauds have been reported as a result of check manipulation, thus you should be cautious while writing checks to avoid this.

If you write “account payee” on a check, it will be cleared in a specific person’s account, but it will not be able to be paid at the bank’s cash counter.

If you want the cheque you gave to be placed only in that person’s account, write ” Account Payee Only” on the check, and the cheque will be deposited only in that person’s account and not handed over as cash.

This is the most important point to assure safe cheque payment to the payee.

Above is an example of how to write “A/C payee” on a check.

If you look closely at the check, you’ll notice that there’s plenty of room to write the payee’s name and the amount.

There is still a lot of blank space after you write the payee name. You must draw a line over this empty spot so that the fraudster is unable to write anything in there.

Please see the image above for instructions on how to draw a line after the payee’s name and amount.

In the above image, right hand side Bearer” is mentioned at the end of the payee name, which signifies that the person whose name is inscribed in the cheque or anyone else who is bearing the cheque can cash it.

As a result, you should always remove the word “Bearer” from the check. This adds to the security of the check.

When writing a cheque, don’t leave too much space between the two words; if you do, the fraudster can change the name on that empty space.

The cheque will be paid to someone else as a result of this change, and you will suffer a financial loss as a result of this change.

Ritik Kumar : If you are leaving much space then its wrong style of writing.

If you allow additional space, a fraudster can modify the payee name from Ritik Kumar to Ritika Kumari as shown in the example above.

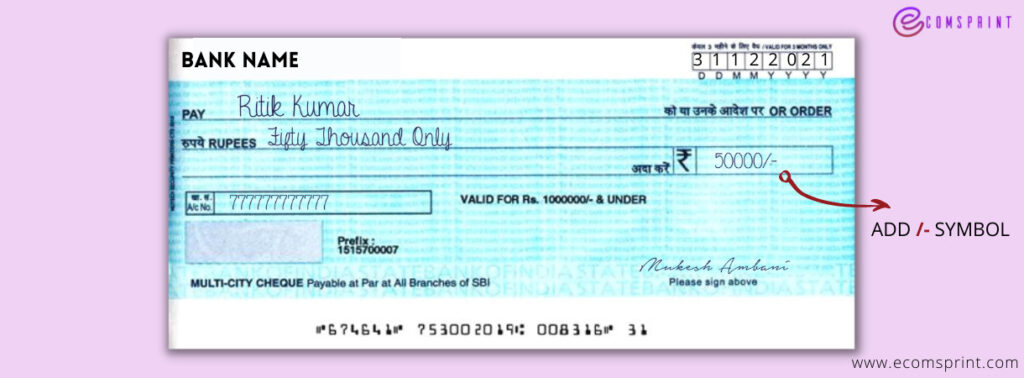

If you do not use this indication at the end of the amount in the figure ” /- “, someone may be able to change the amount of the check.

If you put 8000 on a cheque and send it to someone, a fraudster can change the amount on the check from 8000 to 80000, hence the correct way to write the amount in the figure is Rs.8000/-.

If you give a person a check and they lose it, you must promptly give a stop payment instruction in writing to the bank, or someone else will use the check and you will lose money.

Stop payments can also be made by digital plate forms such as net banking, ATMs, and phone banking.

If you give a person a check and they lose it, you must promptly give a stop payment instruction in writing to the bank, or someone else will use the check and you will lose money.

Stop payments can also be made by digital plate forms such as net banking, ATMs, and phone banking.

If it is not essential, avoid signing an additional signature because if someone changes the payee name or amount, you will not be able to win a court action because your signature is present, proving that you were aware of the change.

The extra sign allows the fraudster to change the payee name and amount, and you will be unable to resist because you have signed the document.

You can also attach the Payee name using Cello tape; this will prevent anyone from changing the name or amount, and your cheque will be protected and will assure safe cheque payment to the payee only.

If you secure your check using cello tape or transparent laminate sticker then no one will be able to alter it in the future.

No one will be able to withdraw more money from the maximum limit if you write the maximum limit on the check.

If you write a maximum limit of Rs.10,000/–, for example, no one will be allowed to withdraw more than Rs.10,000/–.

You can see in the A/C payee cheque above, its written that “VALID FOR Rs 1000000 & UNDER”. So if someone write a cheque above 10 Lakh then it will not be valid.

This will safeguard you from any type of scam.

What precautions should we take before writing a check to ensure that fraudsters cannot misuse it? You should take precautions before writing a check to ensure that there are no chances of fraud and to prevent legal difficulties.

Your financial security stems from your reluctance to write a cheque properly.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |