Shop101 Supplier Guide 2021 FAQ Answered

How to Downlaod Shop101 Sales Report?

Here is where you can download the Sales report:

- Go to Manage Orders

- Select the start and end dates

- Click on ‘Download Sheet’

This will help you understand your order and payment status.

How to check upcoming payments on Shop101?

Curious to know about your upcoming payment? Here is where you can find out upcoming paymenys

By clicking on “Upcoming Order Payments” you will find all the orders which have been delivered to the buyer but the return window of 5 days is not closed.

Once the return window is closed, your payment for that order is confirmed to be released in the next payment cycle.

Where to check Shop101 policies updates?

Click on Announcements to stay updated about Shop101 policies and changes to the Supply process structure.

“Announcements” allows you to find out all you need to know about the changes in policies and any updates which we at Shop101 want our vendors to be peaked about.

How to download Shop101 payment invoices?

Simply, click on “Download Sheet” next to the respective date for which you want the payment sheet for. “Download invoices” will allow you to get the GST invoices which were generated in that week. Payment sheets are uploaded to the panel on every Tuesday for the payment released in the previous week.

We all want to know if what we have been doing is paying up. Here’s how all about your payments:

In the payout sheet, the first tab has details of orders delivered during the previous week. The second Tab has Refunds & Deductions. The sum total of Payment Due – Penalties & Deductions + any Refunds due is the amount credited to your account.

When will I receive the payment for my delivered orders ?

As per Shop101 payment cycle, payment of delivered orders is released on the next week’s Friday. For example, if your order was delivered between 13th June 20 (Saturday) and 19th June 20 (Friday), then the payment will be released on 26th June 20 – Friday and the cycle continues.

How to track my order?

Once you have dispatched your order, you can review the same and check the whereabouts using your WS panel. Log in to your WS panel menu using your registered phone number and click on “Manager Orders” option. Select the “To be dispatched” option and you will be provided with a list of hyperlinks. Click the link associated with the order which you wish to track and the page will be directed toward the logistics website along with the tracking details visible to you.

My order was delivered but I did not receive the payment, Why did i not receive the payment?

Your order was delivered on a certain date but Shop101 allows the buyer 5 days from the date of delivery to return the product if they want to. If the buyer chooses to return the order they will place a return request in the application and an email will be sent to the Vendor (you) notifying you that your order is being returned. Reverse shipping is arranged for the order to be returned to the supplier within 07-10 days. Sometimes, it may take more than 7-10 days for the order to be returned. Vendors need to connect with their assigned Key Account Managers to seek assistance in such orders. To track the return orders you may download your Sales report for that particular month which will allow you access to the links of the return orders.

How to download Shop101 sales report?

To download the sales report, please follow the given steps:

1) Login to the Wholesaler Panel

2) Click on Manage Orders

3) Select Start & End Date (maximum of 60 days)

4) Download the necessary Sales Report.

You also need to make sure that you have updated your bank account details in the system to be able to receive the payments on a timely basis. You can update your bank account details in the Shop101 application in “Your bank details” option or seek assistance from your Key Account Manager.

(Note- Bank account details submitted in the application need to match the details you have provided to your bank. Any changes in the provided details may lead for the payments to being unprocessed/bounced.)

I have received a different product than what I had dispatched in return. What should I do?

If a supplier has received a different product which does not belong to them in return then, they need to highlight the issue through email at paymentdisputes@shop101.com and to their Key Account Manager’s official email within 2 days from the date of receiving the product. (After 48 hours we will be unable to approve your claim) The vendor needs to share the Order ID of the product in the email body or the email subject line and attach the unpacking video along with an image of the invoice/shipping label. It is absolutely necessary for the vendor to share the unpacking video as claims will be denied if these details are not available. Shop101 Payment Disputes team will validate the claim and revert to the vendor’s email within the next 48 hours with an approval or denial of the claim.

I have received a different/damaged product OR empty package than what I had dispatched in RTO. What should I do?

In such cases, vendors need to accept the order and make sure that a note is made in the POD of the delivering logistics that said order was delivered with the encountered issue. This will help us investigate if the vendor received an incorrect product in return and lower the chances of receiving wrong/damaged returns in RTO orders.

Important Points Light Box

My wrong return reimbursement claim is approved but I did not receive the reimbursement amount. When will I get the reimbursement?

The wrong return reimbursement amount for all supplier claims is collectively released on the first Friday of each month. If a vendor had claimed the wrong return reimbursement in the month of June 20, then the reimbursement amount will be released on the first Friday of July 20. Any claims approved on the first Friday of the said month will be considered as a part of the reimbursement for the next month and thus will be released on the next month’s First Friday.

I am unable to process orders on the portal OR generate shipping labels OR unable to access the panel and receiving an error message. How should I proceed?

Technical difficulties often occur in online business but that should not let us stop the business in any manner. Issues such as unable to process orders, unable to generate labels from the panel or issues related to not being able to dispatch orders for xyz reason needs to be reported at supplierfirstmile@shop101.com and your respective Key Account Manager at their official email. Please make sure that you have mentioned the Order IDs of the order in the email body for record purposes. This allows the KAM team to take prompt actions and get your order dispatched within SLA or at least prepare alternatives in case the delay in dispatch is imminent. This is mandatory in case your order will be cancelled to avoid penalty charges.

I have received my payment for this week but did not receive the payment sheet. When and where can I get the payment sheet?

Shop101 shares payment sheets for every positive payment that is released each week. Payment sheets house crucial details such as, Order IDs for which the payment was released, penalties which were deducted, GST/TCS charged on each order, Shop101 commission charged on each other and Shipping charges charged. Payment sheets are uploaded to your WS panel on each Tuesday for the payment released in the previous week’s Friday.

Following are the steps you can use to download your payment sheet:

- Login to the Wholesaler Panel

- Click on the ‘Payment sheets’

- Find the date of payment for which you wish to download the payment sheet

- Click on ‘Download sheet’ to download the payment sheet.

(Note – Payment sheets are downloaded in .xlsx format which is accessible using MS Excel)

Payment sheets are not generated for 0 (zero) & negative payments)

Here’s an example of how the options should look like –

My order was dispatched a month ago and returned by the buyer but I have not received it in return. Where can I find it’s details?

(In such cases, please do not request status/payment concerns for bulk orders).

Details of all of your orders can be found in a single consolidated sheet named “Sales report” which can be downloaded from your WS panel. Steps to download payment sheets have been provided in Point 2. Once you have downloaded the Sales report, you will find details such as Current order status, Forward tracking ID, Payment details (if the order is delivered), Return Tracking ID and the logistics website link to track your return orders. You can make sure of this information to track your return orders on a real-time basis. If in case, the order for which you are checking the details shows the order as returned but you have not received it then, you may request for a POD from payment.disputes@shop101.com or from your KAM within 45 days from the date of order placing.

It is not necessary that logistics will provide PODs of all the orders for which you have requested the PODs for. If you have requested more than 10 PODs then we shall provide you with 5-7 PODs on a test check basis assuming that you have not maintained records of the same.

I was charged with a penalty on a few of my orders after dispatch/cancellation. How should I avoid being penalized for orders OR minimize my penalties?

Penalties during order dispatch are charged if any order was dispatched after SLA (in RTO) or was cancelled by the buyer after the SLA date. After receiving an order, it needs to be dispatched within 2 day (48 hours) which is also our SLA. Failure to dispatch within SLA will result in a penalty charged to the order is said order is RTO. We believe that the risk of order being rejected by the buyer increases more the dispatch of the order is delayed.

We also charge penalties if the order was cancelled by the vendor for xyz reason. Cancellation due to products out of stock also attracts a penalty. If a vendor wishes to mark a product as out of stock, then the same needs to be highlighted to the KAM on a priority to avoid receiving orders for those products and later being charged with penalty for cancelling these orders.

I was charged with return charges on orders. Why were these penalties charged?

Return charges are charges when an order is returned by a buyer for any reasons. These charges are based on the weight of the product. If the weight of the order is less than 500gms then Rs.110+GST18% will be the return charges levied on the order. If the weight of the order is more than 500gms then Rs.150+GST18% will be levied. Only exempt to these charges is for Private label vendors.

I want to know the process of filing my GST for Shop101 sales. How should I do that?

Remember to book Sales on your books (WS price + Shipping) as listed in your payout sheet in the name of Reseller and reseller’s state. Alternatively, refer to the Announcements section on the Seller panel (WS panel) for the same. Shop101 does not generate/provide sales invoices for each order. The vendor has to generate these invoices on their own using the details available in their Sales report or the weekly payment sheet for the particular month. These invoices should be only generated for delivered orders. In the case of returned, RTO and cancelled orders, vendors also need to generate a manual credit note. If the order was placed in the month of March and was delivered in the month of April (example orders placed on the month end) then, the sale will be considered in the month of April since Shop101 only considers delivered orders.

How do I show sales in my books?

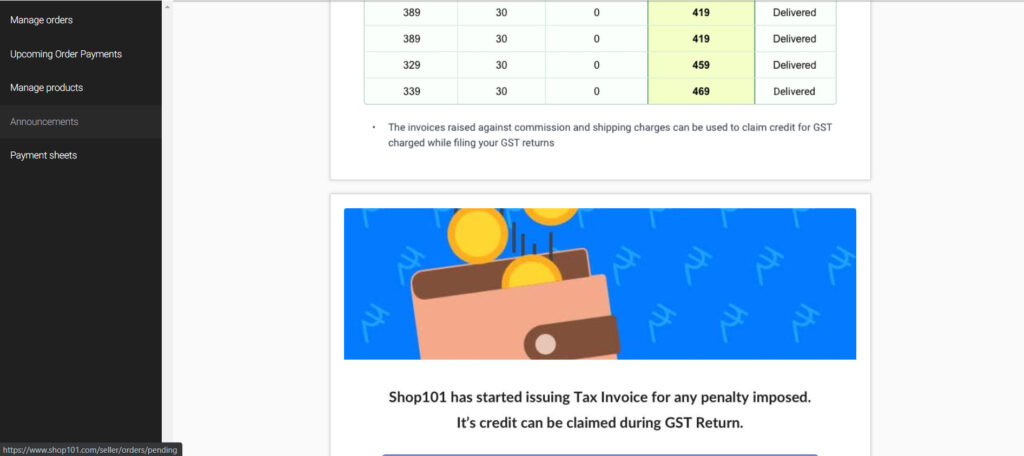

The transaction between the WS and Shop101 is of Reselling i.e. the WS is coming on Shop101’s platform for Reselling. Shop101 is providing two services to the WS one for showcasing the product for which the Commission is charged and the other for shipping services. Hence, Shop 101 is providing two Invoices along with every payout which is commission and shipping Invoices.

- The Invoices are a Sale for Shop 101 and are an expense to the WS which can be claimed as a credit in the GST Return.

- The WS would book the Sales in the name of Reseller which is a B2C transaction. The Price at which Sales would be booked is (WS Price + Shipping) which would be inclusive of Product GST.

- The Accounting entries in the books of Account would be as follows:

- When Sales is booked

RS A/C Dr 500

To Sales 500

- Money Credited by Shop101

Bank A/C Dr 300

To Shop101 300

- The Expense to be booked (Shipping & Commission Invoice)

Exp A/c Dr 200

To Shop 101 200

- Final Settlement

Shop101 A/c Dr 500

To Rs A/c 500

How can I claim my TDS reimbursement?

Reimbursement for TDS is issued as per the following terms:

- Shop101 raises 3 Invoices First for Shipping (194C) and the other for Commission & Penalty charges (if applicable) (194H) and (194O).

- TDS to be deducted is 5% on Commission & Penalty charges (exclusive of GST) and 2% on Shipping (exclusive of GST).

- When submitting your request for TDS reimbursement it is mandatory to provide the PDF copy of Form 16A which was filed for that particular quarter.

- Requesting you to please file the Return under correct heads so that both the parties are complying with the regulations.

How do I get my Sales ledger from Shop101 Accounting?

Shop101 does not maintain any accounting ledgers for any vendors individually. For reference the vendor can refer to their bank statement and find the amounts which have been credited to their account by the name of O(1) India Private Limited. You may also tally the amounts using your WS panel and referring to the amounts of payments in the “Payment sheets” page.

If you have encountered any other issues then the Shop101 Payment disputes team is available from Monday to Saturday – 10 AM to 07 PM and contactable at – paymentdisputes@shop101.com. You can expect a revert within 3 – 4 days.