Are you a Flipkart seller? If so, do you know how much information you can get from the sales report, and if you’re a new seller on Flipkart, do you know how to get your sales data to file your monthly GST return?

In this article, we’ll discuss about the sales report and how to get it from your Flipkart Seller Dashboard.

Let’s begin by analyzing the Sales Report. How can this report assist you in keeping your books of accounts up to date and complying with statutory requirements? Flipkart’s Sales Report allows sellers to keep track of all of their sales across a period of time. They can use it to enter their sales and pay their sales taxes, if any are due.

How will the Online Sellers benefit from the Sales Report?

The monthly Flipkart Sales Report is a report that summarizes the previous month’s sales. This report includes information on all b2c (business to customer) invoices created, returned, cancelled, or cancelled by the seller during the specified month, as well as TCS and offer details, if applicable.

By properly disclosing all sales-related data in their GST monthly return, online merchants can avoid future lawsuit or assessment issues.

What date are included in Flipkart Sales Report?

The following information is included in the Flipkart sales report: Sales, Returns, Cancellations, and so on.

- GSTIN of the seller

- Order ID

- Product ID

- Title and Description of the product

- FSN (Flipkart Serial Number)

- SKU

- HSN Number

- Event Types such as (Sale, Return, Return, Cancellation)

- Type of Order (Prepaid or Postpaid)

- Fulfillment Type

- Date of Order

- Date of Order Approval

- Quantity of Product Ordered

- Order shipped from the state

- Discount

- After discount Price

- Fees for shipping

- Final invoice amount.

- Taxation Type

- Value Subject to Taxation

- Taxes such as IGST, CGST, SGST, Cess, and others are detailed.

- TCS rates for interstate and intrastate payments, as well as the amount of TCS IGST, TCS CGST, and TCS SGST.

- Buyer’s Invoice Number

- Date and Amount of Buyer’s Invoice

- State and Pincode of the customer’s billing address.

- The stage of the customer’s delivery and their Pincode.

Steps to Download Flipkart Sales Report

The steps for downloading your monthly sales data from your Flipkart Seller Dashboard are as follows:

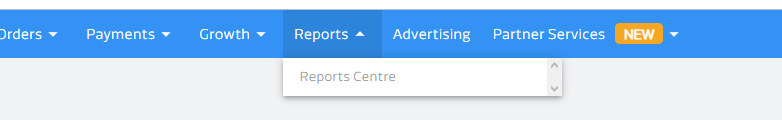

1. Go to your Flipkart Seller Dashboard and sign in. From the main menu, go to Reports and then Reports Centre, as seen in the image below.

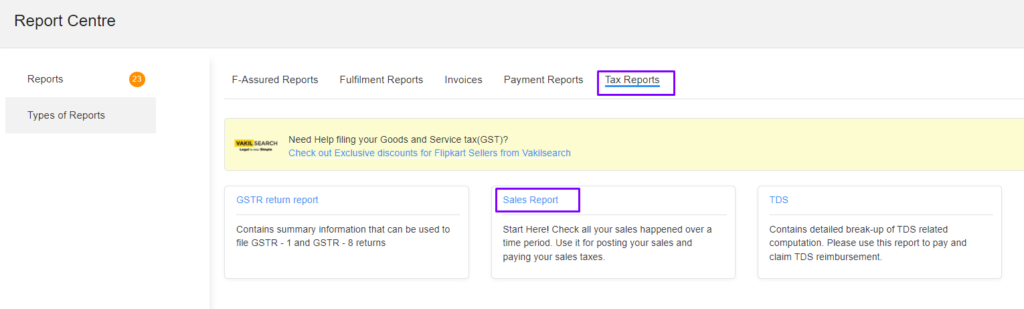

2. Select “Report Type,” then “Tax Reports,” and finally “Sales Report.”

3. By selecting the chosen month and clicking “Generate,” you can now generate your Flipkart monthly sales report.

4. The status “Download” will appear under the Action after a few seconds. Simply save the report to your computer, which will be in Excel format.

Sunil Kumar Sah @DigitalSunilSah

E-commerce Seller, Blogger, YouTuber

Sunil is a digital enthusiast and passionate about Online Selling. He loves sharing my knowledge and experiences on eCommerce on this blog and his YouTube Channel “Ecommerce with Sunil“

How to Sell on Big Basket

Who Can BecomeBig Basket Seller? Big basket is one of the Largest online stores in India which connects sellers and buyers on its platform which works on

How to create a consignment and send inventory to Flipkart warehouses?

In this blog, we will learn how to create a Flipkart consignment and send our inventory to Flipkart warehouses. Step 1: Go to the inventory

Must have Softwares & Tools for Online Sellers

In the fast-paced world of e-commerce, having the right tools can make all the difference. Whether you’re a seasoned seller or just starting out, these

Meesho Seller No-Pack Program Policy

The Meesho Seller No-Pack Program Policy written below is what is mentioned on the Meesho Supplier Panel. Find it under the Settings tab. Policy: Implementation

Meesho Seller Branded Packaging Policy

The Meesho Seller Branded Packaging Policy written below is what is mentioned on the Meesho Supplier Panel. Find it under the Settings tab. Barcoded Transparent

Meesho Seller Return Claims Policy

The Meesho Seller Return Claims Policy written below is what is mentioned on the Meesho Supplier Panel. Find it under the Settings tab. Return Claims